Materiality assessments determine priorities

An ESG materiality assessment is a formal exercise in which a company determines how relevant and important specific ESG issues are to them and their stakeholders. It can help to determine material issues for the first time or serve as a check for existing priorities and gut feelings.

Once completed, a materiality assessment is used to inform the creation of meaningful ESG targets and practices that are relevant to the company and support its strategic direction.

Exactly what counts as material may vary somewhat based on the reporting standards, the goals of reporting, and the key stakeholders. While investors may be focused on what is financially material in the short to medium term, other stakeholders may be more concerned with obtaining a holistic view of the company’s ESG impact and risks.

The exact goals and target audience of ESG reporting, including the materiality assessment process, should be addressed prior to beginning a materiality assessment.

Conducting a materiality assessment

Materiality assessments nearly always include the same general phases. While the nuances of the process may vary based on the company, the basic components of a materiality assessment are the same.

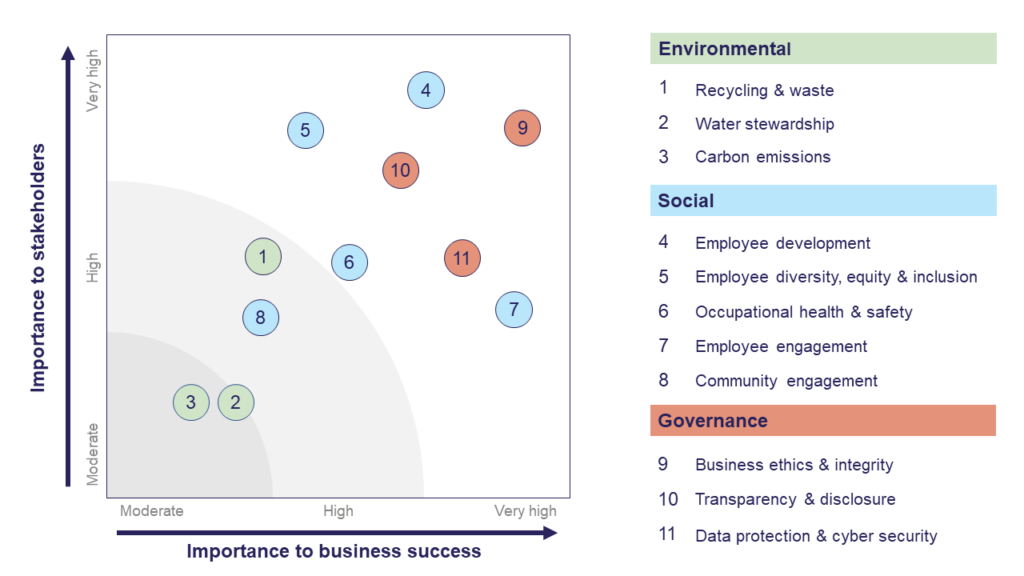

First, a company conducts extensive research to identify and evaluate topics that could be relevant. Then, data is collected from and about selected stakeholders to identify issues of importance to them. Finally, the research is analysed, synthesised, and mapped.

With a completed materiality matrix, the company can easily identify activities that have an impact on the business and importance to stakeholders. Material issues can then be incorporated into business strategy decisions and included in ESG targets, monitoring, and reporting.

A strong materiality assessment helps to ensure that company resources are devoted to attainable ESG targets that drive a competitive advantage and reduce risk.

The three core phases of a materiality assessment

Here are the key stages to conducting a materiality assessment:

1. Topic identification & Risk Evaluation

The first phase of a materiality assessment is to identify issues that pertain to the company and assess their risks. This comprehensive process should cover all financial, operational, and transaction risks to the business, as well as risks to society that are related to the company’s activities.

Topic Identification

An ESG-focused research process is used to identify relevant topics. Common industry risks can provide a strong starting point by highlighting areas which may be of particular concern. Regulatory and compliance considerations also provide insight into key issues.

The company’s supply chain is mapped and ESG risks in the supply chain are identified. A thorough review of the supply chain is essential; companies are responsible for their indirect risks too.

In assessing the supply chain, additional considerations like country-specific risks are weighed. Activities or suppliers in high-risk countries might bring different or more critical risks that would otherwise not be addressed.

Existing company policies, codes, and procedures are also reviewed. These documents can provide insight into previously anticipated risks as well as the mitigation strategies that are already in place.

Risk Evaluation

Identified risks are evaluated to better understand their relationship to the company.

Risks are categorised according to their topic (climate, human rights, etc.) so that predominant topics can be seen. Each risk is then evaluated to better understand who or what it impacts, the scope of its impact, the timing of current or future impact, and the company’s level of responsibility for or contribution to that risk.

The risk evaluation provides a strong understanding of the risks the company faces. By completing a thorough risk evaluation, the company can weigh the concerns of stakeholders with the greatest and most urgent risks to establish its ESG priorities.

2. Stakeholder analysis

A stakeholder analysis is the second phase in a materiality assessment. The stakeholder analysis aims to understand the ESG-related priorities of selected stakeholders through engagement or research. The data from stakeholders is analysed and mapped to highlight which stakeholders are of greatest influence and concern.

Selected stakeholders might include management, customers, employees, suppliers, and regulatory bodies, among others. The communities in which the business operates, and society more broadly, may also be considered stakeholders.

Once the relevant stakeholders are identified, a range of research methods are implemented. Surveys can acquire information from customers and employees, while interviews or direct dialogue may be used with subject matter experts and NGOs. Desk research, risk reports, company strategy, and industry associations can all inform stakeholder research. External stakeholders are often asked to consider issues based on relative importance, while internal stakeholders may be asked to reflect on the impact of issues on specific goals or strategy.

The compiled research is then analysed to identify priority stakeholder groups and issues. The results of a stakeholder analysis are frequently mapped to identify stakeholder groups that must be managed, informed, or monitored.

3. Prioritisation and mapping

The third phase of a materiality assessment is the analysis and synthesis of the acquired data to generate a useful map of the priorities.

At this stage, the possibility that an issue will impact the business and its potential magnitude are weighed against its importance to stakeholders. These are considered within the context of the company’s mission, strategy, and lifecycle. The company’s ability to influence the outcome is also considered, to ensure that utilised resources generate value.

The prioritisation process often uses a framework or model to assign a quantitative value to each issue. Although this type of quantitative scoring is beneficial in generating an initial map of priorities, the assigned values are non-scientific approximations. As such, quantitative mapping is best seen as a helpful tool rather than a result. The produced map is then reviewed and adjusted to better represent the company’s final perspective.

Next Steps

Once a materiality assessment has been generated, the company is ready to incorporate ESG issues into its strategy and operations.

Next steps might include:

- Establishing targets related to material issues

- Developing metrics to track progress

- Implementing monitoring systems for lower priority material issues

- Incorporating targets into strategic planning

- Communicating about material issues, ESG goals, and progress through formal reporting and informal communication channels

The materiality assessment allows the company to confidently engage with high priority issues, while still monitoring relevant issues that are outside the company’s current focus or resources. A strong materiality assessment can help to ensure that resources devoted to ESG activities create value for the company.

A materiality assessment can also be an important line of defence against greenwashing because it provides insight into the company’s actual activities and impact. With real impact to discuss and the data to support it, there is no need to include aesthetic or unsubstantiated claims.

ESG communications should focus on material issues and related activities, as determined through the materiality assessment.

ESG is worth the effort

Getting started with ESG targets can be an overwhelming prospect. But even small companies can benefit from understanding the ESG issues that are most material to their business operations.

ESG metrics are increasingly included in investment mandates, and companies that fully integrate ESG into their strategy receive higher valuations. Companies should value ESG progress equally with financial progress to create and demonstrate value.

A comprehensive materiality assessment is the perfect entry point into ESG. The results will clarify risk priorities and help to ensure that ESG activities create value by reducing costs, driving innovation, or creating a strategic competitive advantage.

Are you ready to begin your ESG journey but not sure how to get started? Do you need support in completing a materiality assessment or creating a credible ESG report? Read more about our work with ESG or reach out to learn how we can help your company plan for changing ESG needs.

Ønsker I at arbejde med ESG, men er I usikre på, hvordan I skal starte? Læs mere om vores arbejde med ESG eller kontakt os for at blive klogere på, hvordan vi kan hjælpe jeres virksomheden med at rapportere på ESG: