All exits require preparation

There are numerous potential exit strategies used by owners to dispose of their assets. Companies of all sizes consider or plan for preferred exits well before they expect to initiate them.

For example, start-up founders are commonly instructed to consider their exit strategy as early as possible, as having even a long-term goal in mind can help to ensure that current decision-making aligns with and supports future goals.

The available or preferred exit strategy for a company depends on many factors, including its health, industry and business model, and the owners’ interests. Common exits include financial sales, corporate acquisitions and mergers, and initial public offerings (IPOs).

Additional exits include family business transitions, liquidation, and bankruptcy. These exits have different needs and are therefore considered separately from other exits.

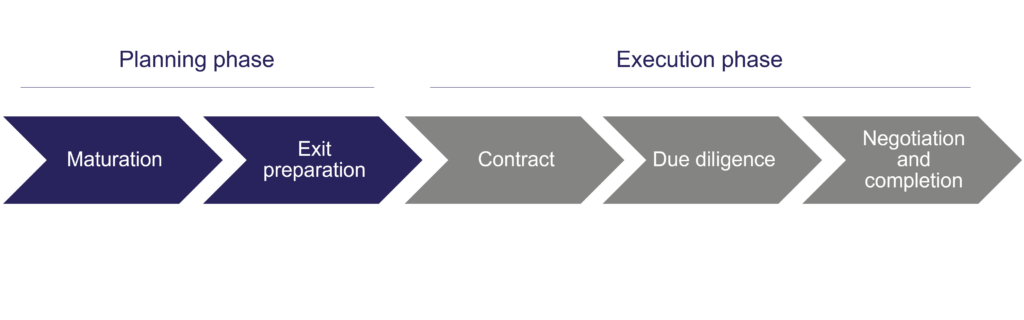

The five steps to exit

The full exit process for an owner-led company can be divided into two phases: planning and execution. The two phases include five main steps that drive a company toward a completed transaction. Most companies will begin these steps between two years and six months prior to the exit.

The planning phase

1. Maturation

Maturation is the time and development leading up to an exit. During this time, the company is looking to optimise its productivity and best practices to demonstrate its strength and strategy.

Consistent revenue, established operations, and efficiency are all indicators of maturity. Alternatively, companies may be looking to prove their strategy and demonstrate significant growth potential to investors. As companies attain maturity, they look to an exit to help the company continue to compete through expansion or refocusing.

2. Exit preparation

Exit preparation is focused around understanding the company’s value and corresponding price. During this step, the company is establishing the operations to support the exit, making investment teasers, creating information memoranda, and preparing for due diligence. Due diligence is often the most intense and challenging part of an exit and is therefore the primary focus of the exit preparation step.

Preparation for due diligence includes the creation of a virtual data room (VDR), an essential platform for making data available to investors or buyers and receiving their data-related inquiries.

In addition to selecting a VDR provider and determining the relevant data to include, a strategy for sharing access to data is developed.

Creating a strategy for data sharing ensures that the VDR supports competitive sales processes, where non-sensitive data may be shared with a wider audience of potential buyers and made available earlier than in non-competitive sales processes.

It also includes the identification of potential red flags. Experienced exit professionals know what investors and buyers are looking for and can recognise issues that may raise alarms. Having this information ahead of time allows the owner to strategise and prepare strong responses that address buyer and investor concerns.

Other preparation includes planning internal and external communications, drafting answers to expected questions, and practicing for Q&A with investors or buyers.

The execution phase

3. Contract

A contract is created between the buyers and the current owners. The buyers may sign non-disclosure agreements to obtain access to confidential data. Legal advisors become heavily involved at this step, as conditions of sale and ongoing obligations for owner engagement after the transaction are discussed and established.

4. Due diligence

The due diligence step includes a deep dive into the company’s health and outlook, which informs the transaction structuring. The buyer or investor generally brings on several third-party teams with different foci to inquire about the company’s history and practices. Their areas of focus include finance, legal, tax, commercial, IT, ESG, and HR.

Companies at the centre of a competitive exit process may have several teams working on behalf of each potential buyer. These teams work simultaneously to obtain data on their own urgent timelines and can create havoc for owners. The challenges of a competitive process may also be exacerbated by the sensitivity of the transaction and the extremely limited number of company employees who are engaged in the confidential process.

Although competitive processes can be uniquely challenging for owners, they also provide an opportunity to negotiate the best deal. In addition obtaining the highest price, the owner can weigh non-financial conditions and considerations, like fit. Non-financial aspects of a deal may be of particular importance for owners who will continue to be involved with the company in a different capacity following its sale.

Significant attention to the exit preparation step and inclusion of external experts during exit preparation can help to make the due diligence process as smooth as possible.

5. Negotiation & Completion

A final deal is negotiated and formally implemented to complete the transaction. Following the completion of the transaction the former owner’s new role begins – whether as an employed manager within the recently sold company, or as an entirely unaffiliated individual.

Thinking about an exit? Start early

Exiting a company can be a challenging and stressful experience, even for owners with an exit strategy in mind. Starting early is the best way to feel confident about the process and fully understand what the company will need to do to be transaction ready. We recommend that owners reach out to us as soon as they start thinking about an exit.

Early contact allows us to help the owner evaluate when the right time to sell the company might be. We will first understand what success looks like, and then assess the market, the company, and the owner, before advising on how to move toward that success.

An exit transaction is a big change for the company, but it can also have a significant personal impact for engaged owners. As trusted advisors, we ensure that both the company and the owner are ready to begin. Our customised exit preparation services focus on the planning phase, but we provide continuous support throughout execution as well.

Even owners who are ready to exit the company are often unsure of many aspects of the process. Starting conversations with us early can help you feel confident in understanding when to begin more formal preparations, when and what to communicate with employees and the board, and what type of timeline is realistic for your exit.

Yes, you do need support

Exit preparation is its own beast – and most companies do not have the experience or dedicated resources to manage it alone. Hiring external exit preparation support ensures that the company can maximise its value during a transaction while continuing to manage its daily operations.

Our exit preparation services take a holistic view to help owners and management navigate the process. Here are some of the key ways we support our clients through exit preparations:

Providing comprehensive expertise and experience

Exits can be a once-in-a-lifetime transaction for many owners, but we have extensive experience with them. We know about the challenges and opportunities of exiting a company and can help owners and their business be ready for them. We know the financial and ESG questions that buyers and investors will ask and will help to formulate answers that address their specific perspectives.

Ensuring that owner financial and non-financial objectives will be met

Owners often have target values or non-financial goals for their exit. We can help assess these goals, strategically manage them, and ensure that communications with buyers or investors align with the owner’s goals.

By preparing for likely questions and identifying potential red flags, we help owners to feel confident that their goals will be met.

Creating order amidst chaos

We will sort records and get them ready for the extensive needs of the due diligence step. Whether a company needs help separating owner records from company records or the business is overwhelmed with data, we can help the owner and company to get organised.

We are experienced with virtual data rooms (VDRs) and will ensure that the VDR meets investor needs.

Facilitating continuous operations

Preparing for an exit can be hectic. In addition to preparing for the exit, companies must continue to manage their daily operations. Our focus on the exit helps to reduce the burden on staff and ensure that they can successfully carry out their normal operations. Smooth and continuous operations will demonstrate the company’s professionalism and strengthen its value to the buyer.

Lending a helping hand

Managing an exit can be overwhelming! We are there to provide support through the process. From collecting and organising data to presenting it and answering buyer questions, we are there to make sure that owners feel confident and positioned to achieve their exit goals. We offer practical services and strategic advice to help owners get the most from their exits.

Planning for an exit is exciting! Involving external exit preparation consultants can maximise the value of the company while helping to reduce owner stress. Whether the company is big or small, our customised exit preparation services can support its unique needs. Reach out early to create a comprehensive plan and facilitate a positive exit experience.

Are you thinking about an exit but not sure where to start? Are you engaged in an exit but feeling overwhelmed by the process? Check out the exit services that we provide or contact us to learn how we can help meet your needs.

Overvejer du at lave en exit, men er du i tvivl om, hvor du bør starte? Er du i en igangværende exit, men føler du, at processen er overvældende? Tag et kig på vores ydelser relateret til exit preparation eller kontakt os for at blive klogere på, hvordan vi kan hjælpe dig i forbindelse med en exit.